Not sure how to go about getting your taxes done? Free tax prep help is here

Volunteer Income Tax Assistance program available at St. John's Episcopal Lutheran Church March 31

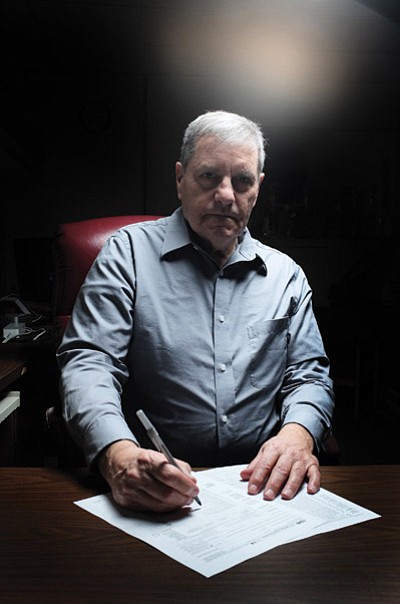

WILLIAMS, Ariz. - Filing taxes can be a difficult process. And confusing. And maybe a little scary.

But Williams residents can get free assistance with their taxes this month through the United Way of Northern Arizona's Volunteer Income Tax Assistance (VITA) program.

On March 10 and 31 from 5 to 8 p.m., volunteers will be available to help file individual tax returns for those who make less than $65,000 a year at St. John's Episcopal Lutheran Church, 202 W. Grant Ave.

Volunteer Brad Massey said volunteers help people file their taxes online, so the process is quick and people usually get their tax return within 10-14 days after filing.

One of the benefits of the VITA program in Massey's opinion is the individualized attention people receive.

"What we've learned is people have questions," he said. "They go to a tax preparer and they just do the taxes and they rush them through and they collect their money and they go. A lot of times they have questions about this."

Some of the things the volunteer tax preparers emphasize is the earned income tax credit and the child tax credit.

"Sometimes families don't know that they're qualified for this," Massey said.

This year volunteers will also make sure people have documentation for their health insurance to avoid paying a penalty under the Affordable Care Act.

"Right now it's just a couple hundred bucks, people might say 'I'm not going to worry about it,'" Massey said. "But this next year it will be more."

People who didn't have insurance in 2014 would pay either one percent of their annual household income or $95 per person for the year and $47.50 per child younger than 18, with a maximum penalty of $285 for the second option. The penalty is whichever amount is higher.

Next year the penalty will increase to either 2 percent of the uninsured person's annual household income or $325 per person for the year and $162.50 per child younger than 18, with a maximum penalty of $975 for the second option.

The VITA program has taken place in Williams for more than 10 years. Massey and Doug Peters are the two volunteer tax preparers. Volunteers must go through an IRS certified training before they start. After preparing the tax returns, a United Way employee checks over them for a quality review.

"It goes through one more level to see if we missed something or if there's an error," Massey said. "So it's not just us, there's always a quality review to see that we get the most benefit for our customers."

Massey encouraged people to take advantage of the VITA program because it's a free service.

"To come here to do this, you get the maximum benefit for your dollar," he said. "We have a nucleus here in Williams of people that have been coming for a number of years and we want to expand on that."

More information about the VITA program is available at (928) 773-9813.

- Driver identified in fatal accident on Perkinsville Road Sept. 19

- Latest Tik Tok challenges causing problems for Williams Unified School District

- Search at Grand Canyon turns up remains of person missing since 2015

- Plane wreckage and human remains found in Grand Canyon National Park

- Pumpkin Patch Train departs Williams starting Oct. 5

- Update: Man missing in Grand Canyon National Park hike found alive

- Receding water levels at Lake Powell reveal missing car and driver

- Man sentenced for attack on camper at Perkinsville

- Column: Lumber prices expected to stay high through 2022

- Elk rut season in Grand Canyon: What you need to know

SUBMIT FEEDBACK

Click Below to: